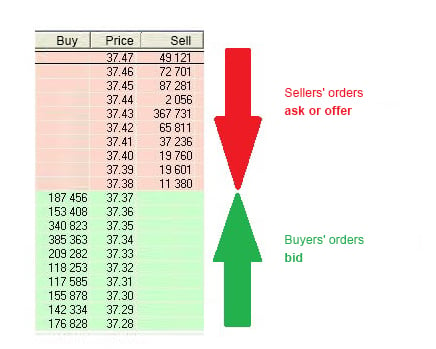

## Automated Market Maker (AMM) Open Class For Certificate in Blockchain Development --- ## `$WHOAMI` * DeFi developer and Web3.0 Instructor. * Currently, * Building $DINERO * Blockchain Instructor at York University * Previously, * CTO and lead Blockchain Developer at opty.fi * Adjunct Professor at George Brown College --- ## Topics * Decentralized Finance * Order book based exchange * Decentralized Exchange * Constant Product AMM --- ## Decentralized Finance * **DeFi**: Financial systems built with smart contracts as the platform for enforcing rules, instead of legal system * The intersection of economics and blockchain technology * Benefits are: transparent and permissionless --- ## Trading Order book (OB)  <small>Image Source : https://www.ifcmarkets.com/uploads/images/order_book_2.jpg</small> --- ## OB fundamentals * Buyers/Sellers express their intent to trade by submitting bids/asks * These are Limit Orders (LO) with a price P and size N * Buy LO (P, N) states willingness to buy N shares at a price ≤ P * Sell LO (P, N) states willingness to sell N shares at a price ≥ P * OB aggregates order sizes for each unique price * A Market Order (MO) states intent to buy/sell N shares at the best possible price(s) available on the OB at the time of MO submission --- ## OB limitations * Higher transaction fees and slower transaction speeds. * Each trade requiring on-chain validation, the underlying network’s throughput can become a bottleneck, thus affecting the overall efficiency of the exchange. * off-chain OB DEX have centralization risk --- ## Decentralized Exchange * Platforms that facilitate peer-to-peer cryptocurrency trading without relying on intermediaries or centralized authorities. * Operate on blockchains, allowing users to trade directly with one another while retaining control over their private keys and funds. --- ## Constant Product AMM * An AMM is a special contract that buys and sells an asset according to specific rules * Uniswap is most famous example on Ethereum --- ## Constant Product Rule * Uniswap has a simple rule: The product of the amounts of the assets is a constant <br/>x * y = k * You can swap an amount of token for another amount, but you need to keep the product the same --- ## Constant Product Rule, 2 * Suppose there are 10 of token A and 4 of token B <br/> k = 10 * 4 = 40 * The price of A in units of B is <br/>4 / 10 = 0.4 * The price of B in units of A is <br/>10 / 4 = 2.5 --- ## Constant Product Rule, 3 * I want to buy exactly 2 units of A so I withdraw 2 A tokens from reserves, leaving 8 A tokens * How many Bs must there now be? <br/>8 * B = 40 <br/>B = 40 / 8 <br/>B = 5 * Since B started at 4 tokens I need to deposit 1 unit of B to bring it up to 5 --- ## Constant Product Rule, 4 * Now there are 8 of token A and 5 of token B * `k` remains 40 <span style="margin-left: 20px; color: green; font-size: 120%">✓</span>: <br/>k = 8 * 5 = 40 * The price of A in units of B goes up: <br/>5 / 8 = 0.625 * The price of B in units of A goes down: <br/>8 / 5 = 1.6 --- ## AMM implementation in Solidity ``` // SPDX-License-Identifier: MIT pragma solidity ^0.8.4; // Constant Product AMM contract Uniswapper { uint256 public tokenAReserves = 10 * 1e18; uint256 public tokenBReserves = 4 * 1e18; function getPriceOfA() external view returns (uint256) { return (tokenBReserves * 1e18) / tokenAReserves; } event AmountTokenBRequired(uint256 amount); // e.g. buy only _amountTokenA of TokenA for any price of TokenB function swapTokenBForExactTokenA(uint256 _amountTokenA) external { uint256 _tokenBRequired = ((tokenAReserves * tokenBReserves) / (tokenAReserves - _amountTokenA)) - tokenBReserves; tokenAReserves -= _amountTokenA; tokenBReserves += _tokenBRequired; emit AmountTokenBRequired(_tokenBRequired); } } ``` --- ## References * https://web.stanford.edu/class/cme241/lecture_slides/Tour-OrderBook.pdf * https://medium.com/@orderlynetwork/amms-vs-order-books-in-crypto-a-comprehensive-comparison-85e3a8afcf96